Shapeways: From Shaping Ways to Falling Out of Shape

Once called out as the future of New York City, featured in CNBC's Disruptor50 list, and very recently valued at more than $400 million, Shapeways has lost nearly 90% of its value over the last 12 months. The rise, the stagnation, and the fall teach us some invaluable lessons.

The disruptive technology of additive manufacturing or 3D printing (earlier called rapid prototyping) started gaining prominence in the 80s. And it has been one arena that has grown exponentially over the last two decades with Shapeways being one of the frontrunners.

Shapeways was founded in 2007 by Peter Weijmarshausen, Robert Schouwenburg and Marleen Vogelaar. The concept behind Shapeways was initially developed within the design department of Dutch electronics company Royal Philips, where the three co-founders first met. The company was spun off from Royal Philips in 2008 to become a separate and independent business entity. The Shapeways business model was further developed under the Philips Lifestyle Incubator program, a startup accelerator designed to assist entrepreneurs with the development of new ideas.

Helping creators bring things to life was Shapeways' driving force.

Shapeways started with two main offerings. First was the marketplace where users could buy 3D printed products for art, jewelry, toys, and mechanical parts among other things from stores set up by designers - all manufactured on demand. Shapeways took a fee for handling the financial transaction, manufacture, distribution, and customer service.

The second was a centralized service bureau where designers and users could have their products 3D printed in an increasing range of materials (a print-on-demand service!). This approach was quite different from the decentralized model adopted by the likes of 3D Hubs, another emerging player in the additive manufacturing arena at that point in time.

It was certainly not an easy beginning.

Shapeways needed complex software to manage its operations for both the marketplace and the service buerau. And when Weijmarshausen as the CEO first reached out to developers, many of them laughed and told him it was impossible. But, he never took no for an answer and eventually found a great team that helped shape Shapeways.

Shapeways focused right from the outset on fostering a community of good designers who made inspiring things. It spent a lot of time supporting them so they could make 3D printed work, inspire others and also teach others. It established forums as a focal point for learning, sharing, and discussing 3D printing. It held contests and promoted the work of designers to make them successful. It also approached other communities across aligned verticals that would take well to 3D printing and spent time educating people in these communities so they could become heroes who passed on their skills to others.

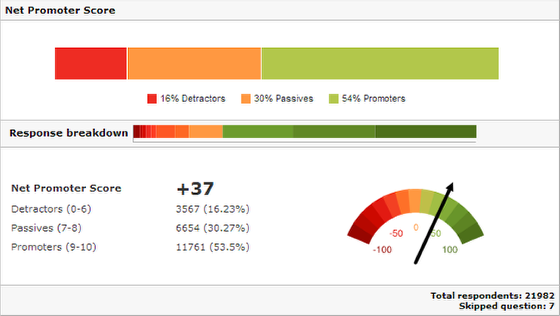

And the team listened intently to those customers who were vocal, told the truth, pushed the envelope, and made the company increase its standards. And to enable this, Shapeways exhaustively used NPS dashboards.

Each week the “Voice of Customer” team used to send out the Community Sentiment Report sharing the top feedback they had heard. Organizing it into sections allowed them to show the high-level themes and drill down into what the data actually means. They used word clouds to pick the top three categories of feedback, the common themes within them, and a quote in the users' own words helping Shapeways' team get both the data point and the 'color' around it.

And, to follow up and act on the identified issues, Shapeways' teams ran “Deep Dive” sessions, where they focused on a topic or a feature that someone in the team was working on and provided them with a breadth of comments received from the community around that topic. For example, in a specific week, one of the teams was working on an image cropping tool. This team pulled up all shop owner comments from the past month that mentioned images and their need for tools. It really helped the product managers put the feature into the context of real users.

Shapeways became well known for launching features, technologies, and innovations much faster than others. The company did a lot of analysis on different community members and their roles. It broke down lots of data to discover that the most active community member was not necessarily the one most likely to buy (while they were quite likely to bring in new people). Also, instead of thinking of what products to make on their own, the team members went to platforms such as Reddit and asked people what they want. At the same time, it worked towards identifying ways in which it could better support creators through the production process: from the conception of an idea to the designing and packaging to the first sale and beyond.

And, perhaps most significantly, the team members at Shapeways took pride in the fact that they were more ambitious than other companies. It was not just another start-up for them. "We are going to change the world," was the motto.

And, Shapeways got traction (albeit it was not alone) along with several other startups in the 3D printing arena. It had grown to almost 60 employees across the Netherlands and the USA. It was serving an estimated 5,000 'shops' by early 2012, which grew to 10,000 by May 2013 and 20,000 by the end of 2014.

When it started its manufacturing facility in New York City, it attracted not just one but five city officials to the christening of the 25,000-square-foot set up in March 2012, including Mayor Michael Bloomberg who called the Shapeways' factory “the future of the city” before ceremoniously cutting a white ribbon with a pair of 3-D-printed scissors.

The major boost for Shapeways came with Andreessen Horowitz (an investor in other unicorn ventures such as Lyft and Airbnb) coming on board leading a funding round of $30.1 million in April 2013. By now, it had already raised almost $40 million across multiple rounds and was valued at an estimated $80 million.

It got featured in CNBC's Disruptor 50 list in 2013. And the purpose-driven, disruptive technology-enabled, and customer-focused business model also attracted Salim Ismail and others who were researching several startups, scaleups, and incumbents through the lenses of the Exponential Organization (ExO) success formula as part of the writing of their book "The Exponential Organizations." And Shapeways featured in the list of Top100 ExOs released in 2015.

The CEO and Co-Founder Pete Weijmarshausen was quite exuberant about the future of 3D printing at large and strongly believed that digital manufacturing was going to bring in the next industrial revolution. On the sidelines of the Inside 3D Printing conference in 2016, he said:

And Shapeways had been certainly leveraging this opportunity and emerged as a success story in the world of 3D printing and weathered the hype storm that had found many other 3D printing startups crashing against the rocky shores of reality. Shapeways was able to achieve very competitive pricing models based on the fact that it had digitized the end-to-end processes allowing a more differentiated cost structure while offering high-quality, flexible manufacturing, which one didn't necessarily see consistently across the industry.

Over the decade of its establishment, Shapeways has been serving the creators in the 3D printing community, affording opportunities to create their products and shops, bringing not only designs but businesses to life through digital technologies with the support of a dedicated team.

By the end of 2016, Shapeways had grown further, with 250 employees globally, working with more than one million community members and 45,000 'shops.' It had achieved the milestones of printing its 10 millionth product and was reaching more than 190,000 designs uploaded monthly.

But the wind started blowing in a different direction. The growth Shapeways had enjoyed started to stall.

While Shapeways and other players in the additive manufacturing industry had led the growth of the exponential technology, the reality was that the 3D phenomenon hadn't scaled as much as it was expected to.

People were considered to be having ideas or want products that could be made and sold thanks to advanced design, production, and fulfillment technology. BUT, most of them didn’t know where to begin. Without proper support or infrastructure, the entire process seemed inaccessible, complicated, intimidating, and expensive. And while the democratization of 3D printing was meant to enable a very simple process with any individual uploading a design and then getting a printed product in the mail, the reality was different.

90% of requests were not deemed fit for manufacturability, with the majority needing some level of design change. There was a lot of back and forth between Shapeways and the customers to make the needed design changes. Given the lack of full know-how of what the end-use application is going to be, Shapeways didn't feel comfortable taking over the design responsibility.

And, while the company improvised and manufactured new products almost on a per-day basis. But, as it grew, Shapeways had to also conquer what one would call the “blank page” problem. Just because customers say, they want something unique didn't mean they will devote effort to acquiring them on an ongoing basis. There was an apparent disconnect between retail consumer expectations and what was accessible, causing a depleting interest in the technology.

Shapeways needed to reimagine the next phase of its existence.

In August 2017, it was announced that the co-founder CEO Peter Weijmarshausen would step down from his CEO role while remaining on the Shapeways board. COO Tom Finn was appointed interim CEO while highlighting that the Shapeways board will be searching for a permanent replacement with the unique set of skills needed to continue the growth and maintain its competitive edge!

And after months of searching, Shapeways announced in February 2018 the appointment of Gregory Kress (ex-General Electric and former president and COO of online learning service Open Education) as the new CEO. At the time of his appointment, Kress had the below to say indicating the future direction of vertical and lateral expansion for Shapeways.

And under the new leadership, the company shifted gears over 2019 and 2020. It pivoted the business model from being a boutique of 3D printing to becoming a one-stop shop for rapid prototyping.

This new strategy involved meant focusing more on partnerships with both material and printing technology manufacturers. The first category was in the form of a gray-labeled software called "Powered by Shapeways" which allowed material manufacturers such as DSM, BASF, Henkel, etc. to leverage its end-to-end manufacturing software platform for their business and make the digital shift and expand their additive manufacturing offerings. This was meant to create a new higher-margin SaaS revenue stream.

The second and perhaps the more interesting shift was to become a go-to-market partner for new 3D printing technology companies that were looking to bring new technologies to market. The idea was to leverage Shapeways existing customer base and get access to newer technologies that may be unique vs. competing 3D print shops. This co-opetition arrangement was exemplified through its MoU with a larger competitor Desktop Metal meant to expand the material + technology offerings - to extend the market reach and the share of the wallet.

But, these strategic shifts didn't alter the fortunes, at least not on the financial performance front.

Between FY 2019 and FY 2020, Shapeways reportedly had a revenue decline of 5%. It also reported net losses of $7 million in FY 2019 and $3 million during FY 2020, as well as adjusted EBITDA of -$6.1 million and -$2.4 million, respectively.

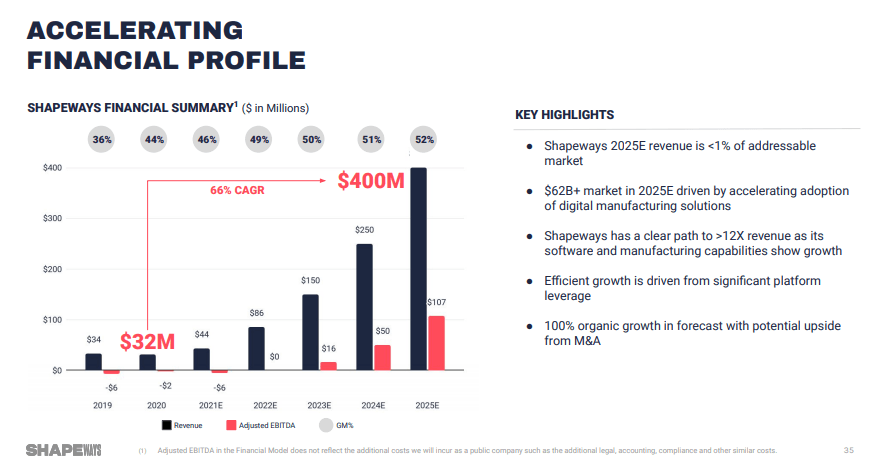

And while Shapeways was apparently stagnating, came a big announcement in April 2021, when Shapeways declared a reverse merger into a special-purpose acquisition company (SPAC) with Galileo Acquisition Corp and a consequent de facto IPO. The transaction implied a pro forma enterprise value of a staggering $410 million and was targeted to bring in $195 million in net cash proceeds (it ended up raising only $103 million when it did hit the street later in Sept 2021!).

And, as part of the IPO announcement, it forecasted 10x revenue growth over the next 5 years! Sounded fairly audacious.

The largest source of this growth was anticipated to be from adding new manufacturing capabilities for additional polymers, industrial metals, composites, ceramics, and "future material innovation", intended to allow the company to expand into new value propositions as well as geographical markets beyond the USA and EU.

Unfortunately, the projections have fallen flat on their face.

Shapeways closed the FY2021 with revenues of $33.6 million compared to the projected $44 million. And in the latest financial data released for Q2 2022, the company generated $8.4 million in revenues,-4.5% less than the numbers achieved in the second quarter of 2021. And the total revenues for the first half of 2022 of $16 million leave it well below the $86 million promised to investors for the full FY2022 at the time of its IPO.

The actual performance against the promised wonderland has got reflected in investors' confidence, with Shapeways' share price falling continuously over the last 12 months since its listing. Its market capitalization has been falling steadily and stands at a paltry $36 million as of September 2022. A 10x reduction!

In fact, earlier in August 2022, Shapeways got notified by the New York Stock Exchange (NYSE) that given the fact that the average closing price has been below $1.00 since July 14, 2022 - if it is unable to improve its share price in the next six months, the company may be pulled off the stock exchange. Shapeways' response - it's considering a reverse stock split!

Has Shapeways moved away from its Purpose? Or did raising money riding on the SPAC wave became the raison d'etre for the Shapeways leadership? Or is it just not having the right strategy? Or is it a lack of focused execution?

The 3D printing industry is continuing to evolve and slowly finding its way back into the mainstream, both in the retail and the industrial space. It is estimated to be a market already worth $40 billion and projected to grow to $120 billion by the year 2030.

Will Shapeways be able to get back in shape and rebuild the exponential attributes it once embraced to achieve the successes it did? Will it be able to reap the benefits of the expected growth in the digital manufacturing industry?

We will be watching closely.

This article on Shapeways is part of a SPOTLIGHT series on some of the TOP100 Exponential Organizations to map their journey over the last eight odd years since the list was initially published in 2015.

To get insights from the successes and debacles, read the stories of other ventures which have thrived but also some which didn't.

DUOLINGO https://insight.openexo.com/startup-success-the-duolingo-way/

TUMBLR https://insight.openexo.com/why-tumblr-tumbled/

GoPRO https://insight.openexo.com/the-rise-the-fall-and-a-resurgence-gopro/

STRIPES https://insight.openexo.com/taking-exponential-strides-the-stripes-way/

ExO Insight Newsletter

Join the newsletter to receive the latest updates in your inbox.