The GoPro Rollercoaster -The Rise, The Fall, and a Resurgence!

Once a role model of entrepreneurship, GoPro hasn't had a perfect picture over the last few years. The rise and fall and the resurgence being attempted teach us invaluable lessons of resilience.

The GoPro story started in 2002 when an avid surfer Nick Woodman went on a surfing trip and quickly realized that there was no way to film himself while in the water. While most photographers shooting surfing images usually used DSLRs with long tele lenses from the beaches, buying these lenses and equipment and hiring photographers was an expensive affair.

This led to the birth of the desire to shoot professional images in dire situations and adventure sports. To help people capture and share their lives' most meaningful experiences in immersive and exciting ways.

Nick wanted the “hero” action shots out on the ocean where the drama was. He also harbored ambitions of turning pro and was buoyed by his surfer friends’ encouragement to find a solution. And that led him first to develop and launch a wrist strap in 2003. It was designed to be attached to a regular digital camera, then hinge up when you wanted to take a photograph. You just pushed it back onto your wrist when you were finished.

But while testing his first makeshift models on a surf trip to Australia and Indonesia, Nick realized that he would have to manufacture the camera, its housing, and the strap altogether. Woodman, after saving up money with his wife by selling seashell jewelry and belts out of their old Volkswagen van in California, together with $235,000 that he borrowed from his mom and dad, started the camera company - Woodman Labs (only to be renamed GoPro later on).

In 2004, GoPro started selling its first-ever camera, named HERO. A small, handy 35 mm compact film camera inside a waterproof plastic housing with a hand-sewn wrist strap. There were only two buttons - a power/mode and a select/record button. What set the GoPro 35mm Hero apart from the rest of the point-and-shoot cameras was its ruggedness. Priced at just $20, it was an outstanding deal for photo enthusiasts and families.

GoPro ended the year with revenues of $150,000 and the following year in 2005 with $350,000 after Nick started selling on the QVC shopping channel. From QVC, Nick managed to get the product into Recreational Equipment, Inc. (REI) — one of America’s largest outdoor recreation retail groups. The product then took off as extreme athletes such as racecar drivers, skydivers and skateboarders purchased the cameras for filming themselves. Point-of-view videos shot by GoPro cameras attached to surfboards, ski helmets, bike frames, and pets suddenly became ubiquitous and viral on YouTube. Nobody had ever seen footage like this; it was a new, dizzyingly personal, and mesmerizing art form. At the same time, Go Pro finally made it into the ‘mainstream’ when it landed on the shelves of Best Buy.

The concept of owning your action camera was a game-changer. People bought them in multiples, and the sports-action genre exploded. Everyone bought into the lifestyle that Woodman was peddling and the sales rocketed. Things started ramping up with GoPro in 2006 when the first-ever Digital Go Pro Hero was introduced, and revenues hit over $800,000. The year after, 2007 saw a massive revenue leap, with GoPro hitting the $3.4 million mark.

GoPro continued to launch new variants through incremental refinements in features and functionalities such as digital, video resolution, sensor size, durability, etc. As time passed, the world around changed, and so did GoPro. It kept on improving and innovating its product line. These technological advancements, along with some savvy marketing and social media strategy, enabled GoPro to build an engaged community of users - a recipe for fostering a virtuous growth cycle.

Over the years, GoPro became the standard for capturing action sports. Just as the word Xerox had become synonymous with Photocopier machines after the inventors named and trademarked their process under that name, action cameras were at one point known as GoPros.

It grew phenomenally, riding on the wave of its popularity. Revenues skyrocketed to $234 million in 2011, then grew to $526 million in 2012, $986 million in 2013, and $1.4 billion in 2014. GoPro was the talk of the town, one of the fastest growing companies.

And this growth coincided with Foxconn, one of the world’s largest electronics manufacturers, buying a $200 million stake in GoPro for roughly 9% of the company in 2013. Then, GoPro made its public debut in the third quarter of 2014 to raise $427 million at a $2.96 billion valuation, the biggest consumer electronics IPO in about 20 years. This reflected its strong position as a popular product segment even as smartphones continued to decimate the camera industry at large.

And the stock surged more than four fold to $98 within three months of its debut.

The purpose-driven and customer experience-centric business model and the stellar business performance of GoPro also attracted Salim Ismail and others who were researching several startups, scaleups, and incumbents through the lenses of the Exponential Organization (ExO) success formula. And GoPro got featured in the list of Top100 ExOs released in 2015.

However, the love affair with the market (customers and shareholders) and the success story GoPro experienced in the first decade of its existence between 2004 and 2014 started falling apart. After peaking at $1.62 billion in 2015, revenues dropped to $1.16 billion in 2016 and then plateaued at $1.17 billion in 2017 and $1.14 billion in 2018.

WHAT WENT WRONG?

The Dwindling Core - In its core camera business, the HERO - GoPro started feeling the heat from mobile phones and cheaper alternatives. With a smartphone, everyone had a camera in their pocket, and GoPro’s USP of being handy and powerful was becoming redundant. And then, smartphones also became waterproof and much more rugged. GoPro's unique selling propositions – ruggedness and being small and handy- were not ‘unique’ anymore.

Also, the GoPro product segment, after gaining immense popularity, started seeing competition from Chinese players giving the same functionality as the GoPro albeit at a lower price. GoPro's most significant challenge perhaps came when Google entered the wearable camera market with a $249 wireless smart camera (compared to GoPro's equivalent offerings, which were priced around $400 upwards). Google Clips used artificial intelligence to automatically capture several-second motion clips when its algorithms detect something photo-worthy. Unlike GoPro cameras, which require dedicated mounts to affix to a helmet, bicycle, or body, Google’s camera was designed so one could clip it to the shirt, a stroller handle, or wherever else one might be able to clip something.

Further, GoPro's pricing strategy (indicating that it perhaps misjudged the market and its brand appeal) ended up seeing the company slashing the prices of its new cameras almost by half within a few weeks of launch on a fairly regular basis. This led to confusion and disengagement in the minds of its customers and even cannibalization instead of growth.

Lastly, while GoPro had started as a niche catering to adventurers, surfers, and travelers, over time, its primary customer base had emerged as skaters, skiers, holidaymakers, and just about any average person. So, while GoPro promoted its products using professional athletes and adventure sports enthusiasts, it didn't focus on showcasing how an ordinary family man or woman could use their product, too, creating a disconnect with the mainstream market. While GoPro had a stronghold among adventurers and extreme sports enthusiasts, other cameras targeted the mainstream. They soon gained momentum, challenging the leadership and iconic position of GoPro that it had established over the years.

GoPro had to expand its horizons and create new verticals for financial stability and growth. But, it wasn't meant to be.

The Pivoting that went Sour - In late 2014, GoPro started transforming itself from being only a camera seller into a media entity, from a hardware to a software company. GoPro's strategy made sense in 2014. Videos from GoPro users dangling off helicopters or diving with sharks racked up millions of views on YouTube. Amazon and Netflix had recently begun their original content push. Even Red Bull, a brand closely associated with GoPro, had just introduced an Apple TV channel. For GoPro, it also meant proving to Wall Street that its business had the potential to be more than just selling cameras to a niche audience of sports enthusiasts.

To kickstart those efforts, it launched an Xbox Live channel and made a deal with Virgin America for in-air entertainment. Its website also acted as a media portal, collecting top photos and videos. The entertainment unit, led by former Skype CEO Tony Bates, initially focused on gaining followers on YouTube and other social media platforms. The sporty hardware company made a series of high-profile hires to bolster its entertainment division in 2015, including the former head of Hulu Originals programming Charlotte Koh, and HBO sports executive Bill McCullough. It briefly produced original content and created a licensing and revenue-sharing platform for content creators.

But, the high-profile efforts were undermined by costly productions amid the tough tradeoffs of a company trying to salvage its core business. The newly formed content team at the entertainment division began spending more and more on their video shoots and production. Budgets went from $10,000 a shoot to $100,000 a shoot. It wanted to come across as a series player, not wanting to cut any corners. It perhaps crossed the line and ended up splurging. The entertainment division developed over 30 TV series and had ideas for releasing their streaming platform. But, most of the shows never made it out of production, and the streaming platform was never launched.

With the core business dwindling and no signs of the entertainment division becoming a profit center on its own, the entire unit was eventually shut down in November 2016. It was not the only tech company that had gotten excited about Media but ended up having a painful exit. Yahoo took a $42 million write-down in 2015 for its investment in shows like Community. The difference was that GoPro didn't have the deep pockets to afford the misadventure.

The Drone Disaster - In September 2016, just in time for the festive season, GoPro made a triumphant launch of its drone, Karma with a dedicated slot for the Hero action cameras. Karma was an outcome of a project initially announced in December 2014 after noticing the success of DJI's drone, the Phantom. But, the project Karma got marred with delays amid a shift from a joint venture with the specialist 3D Robotics to an in-house start-from-scratch research & development effort costing almost $96 million.

But, it soon found competition within a week when DJI launched its line of compact Mavic Pro and Spark drones with more robust features, smaller designs, and lower prices. And to add to the challenge, within three weeks after the Karma devices went on sale, some owners complained about losing power mid-flight, causing the GoPro drone to plummet uncontrollably to the ground. GoPro had to announce a complete recall and take the product off the shelves when it was discovered that the device was losing power during operation. And this was the beginning of the end of Karma. While it relaunched the product in February 2017, it had lost the holiday season opportunity and the momentum and could never recover. GoPro announced the shutdown of Karma in January 2018.

The Organization and Culture - Before the IPO, GoPro had been a relatively simple operation, with sales, marketing, engineering, and design teams working on the company's products. But after the IPO, as GoPro tried to build new businesses, the company unconsciously shifted to a more siloed structure, where multiple divisions - software, hardware, media - ran as separate business units. Individual teams began to embrace tools that worked best for them. Because each team used its arsenal of tools, organization-wide cross-team communication, collaboration, and visibility started becoming challenging and bred bureaucracy.

Previously, GoPro had held quarterly all-hands pep rallies, called hangs, but as it grew in size and geographically, the company moved towards what can be considered a more subdued monthly affair, with Nick Woodman and the other senior leaders giving a speech in front of a few hundred employees (while the rest watched online).

The Leadership! - While paradoxical, Nick, who was undoubtedly the central brain and the hustler behind GoPro's stellar growth, also potentially ended up becoming a bottleneck.

In the early years of GoPro, Nick is known to have driven up and down California’s beaches selling his necklaces from his 1971 Volkswagen to make the cash he needed to pursue his passion. And, when not selling necklaces from a VW, he would work on a sewing machine borrowed from his mother. He would design different straps and test what worked best. At night he would stay up late to speak with factories in China regarding camera parts. He was hustling and working up to 18 hours a day, seven days a week, for months.

Fast-forward 10 years. After the successful IPO in 2014, Nick became an instant billionaire. In a matter of months, his wealth had hit the $3 billion mark, and he had become the highest-paid CEO in America. Over the years, while amassing his wealth, Nick bought a 180-foot yacht, a Gulfstream G5 jet, homes in Montana and Hawaii, and a fleet of vintage sports cars over the years. And, somewhere, GoPro as a company had been adopting its founder's flashy lifestyle.

While hindsight is always 20:20, Nick admitted during an interview with Inc magazine in late 2018 that "We went from being thrifty and scrappy and efficient and wildly innovative to being bloated and–what’s the opposite of thrifty? It was deconstructing everything we had built."

A RESURGENCE IN PROGRESS!

GoPro's Founder and CEO Nick Woodman, during an interview with the Inc magazine in 2018 said "When things are going well, you can be lured into thinking that everything’s easier than it is. Just because you’re a World Series-winning pitcher doesn’t mean you can go play quarterback."

After nearly four years of struggling performance after its IPO - GoPro pivoted once again in 2018 and shifted gears to focus on profitable growth and declared that it would go back to what it does best and feels strongly about - action cameras.

In 2018, GoPro announced many upgrades to its Hero camera and also the launch of a new spherical camera called Fusion, which could pull out any still or moving image from the spherical footage - a feature called OverCapture that essentially made it possible to shoot in multiple directions at once and frame one's photo or video after shooting. This was undoubtedly considered by the technology pundits and the market as a true innovation and potentially the beginning of the company coming back on track. GoPro has kept introducing innovations and an improved range of products and accessories over the last four years and has been acknowledged in the form of different awards, including CES Innovation Awards Honoree, CHIP Photo Awards, PCMag Best of the Year, amongst others.

GoPro's innovations have also been targeted toward shifting the product mix to the high-end premium camera segment. Its>$400 average selling price cameras account for nearly 80% of the revenues in Q2 2022 compared to only 40% in 2018. Think iPhone!

Also, GoPro has been expanding its direct-to-consumer (DTC) business and its footprint in emerging markets while scaling up its customer relationship management and engagement efforts with frequent new product launches acting as tailwinds. So, while retail used to account for nearly 90% of its sales in the pre-2018 era, now it accounts for only 60%, with DTC accounting for 40% of its latest reported financial numbers, also helping improve margins from low 30% to nearly 40% now.

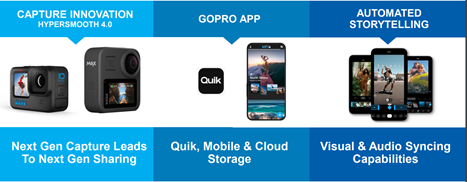

The company also re-launched its subscription and service model GoPro PLUS. The service provides subscribers with significant savings on cameras and accessories, an assured replacement for damaged cameras, but more significantly, unlimited cloud storage, the capacity to upload footage to the cloud directly from GoPro cameras, premium editing tools in the Quick App, and a private streaming platform to enable storytelling and immersive sharing - going back to its roots and its purpose.

By the end of the second quarter of 2021, GoPro subscribers were up from a small 355,000 in the first quarter of 2020 to 1.16 million, and in the recently announced results for Q2 2022, these had increased further by 71% to 1.91 million.

On the internal organizational front as well, GoPro has been investing in building a collaborative environment. Earlier, the internal beta testing at GoPro was typically done for small groups of people closest to the product, and the feedback loop was primarily between just the testers and the product team. Now, the company has extended the reach of the feedback loop, increasing engagement for a broad set of employees and even building internal hype around the new product introduction efforts. Further, GoPro has been leveraging technology to empower and capture the collective personal retail experiences of its global workforce to report on the status of more than 27,000 global POP (point of purchase) retail displays, to choose what questions management will address at all-hands meetings, and for myriad other ways that help the GoPro workforce feel connected, empowered and prideful for what they represent to the global community of GoPro users.

These revival efforts have perhaps arrested the decline GoPro had started experiencing between 2015 and 2018, with GoPro delivering revenues of $1.16 billion in 2021 but certainly better profitability with adjusted EBIDTA standing at $168 million compared to only $22 million in 2018. However, the street doesn't seem to be convinced yet. From the peak market capitalization of $11.8 billion in September 2014, GoPro is valued at a paltry $900 million as of the beginning of September 2022.

GoPro aspires to be a force for positivity, celebrating all things awesome while inspiring people to pursue their passions. It has an opportunity to leverage its purpose, values, brand-appeal and social media reach to sustain the momentum it has garnered over the last few years.

Will it be able to regain the glory of the first decade of its existence? Will it be able to bounce back and deliver sustainable and profitable growth? We will be watching closely.

This article on GoPro is part of a SPOTLIGHT series on some of the TOP100 Exponential Organizations to map their journey over the last eight odd years since the list was initially published in 2015.

To get insights from the successes and debacles, read the stories of other ventures which have thrived, but also some which didn't

DUOLINGO https://insight.openexo.com/startup-success-the-duolingo-way/

TUMBLR https://insight.openexo.com/why-tumblr-tumbled/

ExO Insight Newsletter

Join the newsletter to receive the latest updates in your inbox.