Survive OR Thrive : It's Time to Reinvent Your Organization

Organizations that embrace reinvention grow and are successful. The topline growth and declines for some of the large global organizations between 2011-2021 proves that being exponential is not only necessary but an imperative.

Half a century ago the life expectancy of a firm in the Fortune 500 was around seventy-five years. This means, that a typical organization could go for years without making any profound changes to its business and operating models. They could basically continue selling the 'same' products and services to the same markets, and they’d do fine. They could continue following the same set of policies and business processes, or, at best, "improve" them incrementally over years. They could have the same set of organizational structures, and the same skill and talent profiles.

Today’s businesses, however, don’t have that luxury. The life expectancy of a firm has got reduced to 10-15 years (or even less!).

Many business leaders are comfortable with the mere vision and mission and a strategy of "surviving" and "hanging around."

And this survival conundrum is applicable not just at an organizational level but broader at the global industry/arena levels.

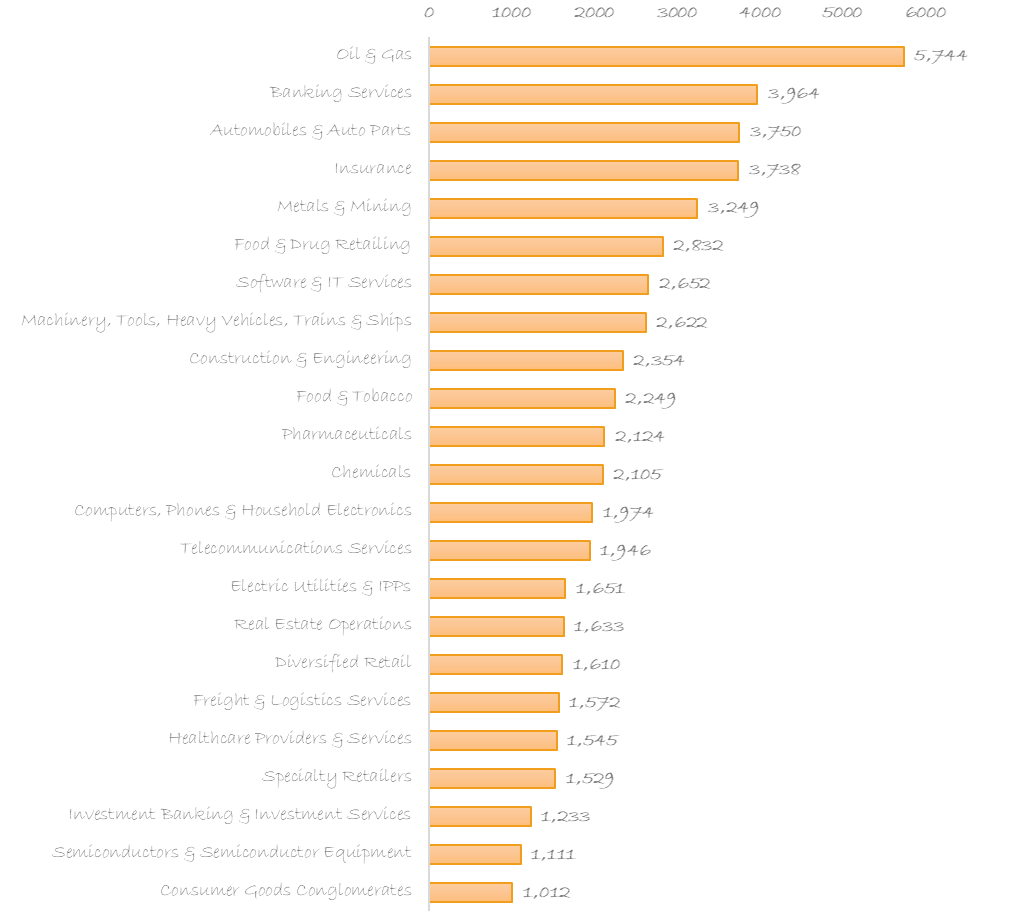

If we were to consider the revenues being generated by publicly listed organizations across geographies a representative of the size of different industries, then Oil & Gas, financial services, and Automobile are the largest business sectors accounting for nearly 30% of the global corporate revenues.

The cumulative revenue across all sectors and across all geographies for the 22,000+ firms with revenues greater than USD 100 million (for the financial year 2021) analyzed was a mammoth USD 68.4 trillion. To put things in perspective - the total global economy was an estimated USD 96 trillion in 2021.

Before being brought to a halt over the last 2 years, initially by COVID-19 in 2021 and then the Russia-Ukraine crisis in 2022 (and the supply chain issues, recessionary trends, and the drastic meltdown in the global financial markets!), the global economy after the financial crisis of 2008-2009 had certainly been on a positive trajectory for more than a decade. During this period, the average growth rate of the global economy was around 3%.

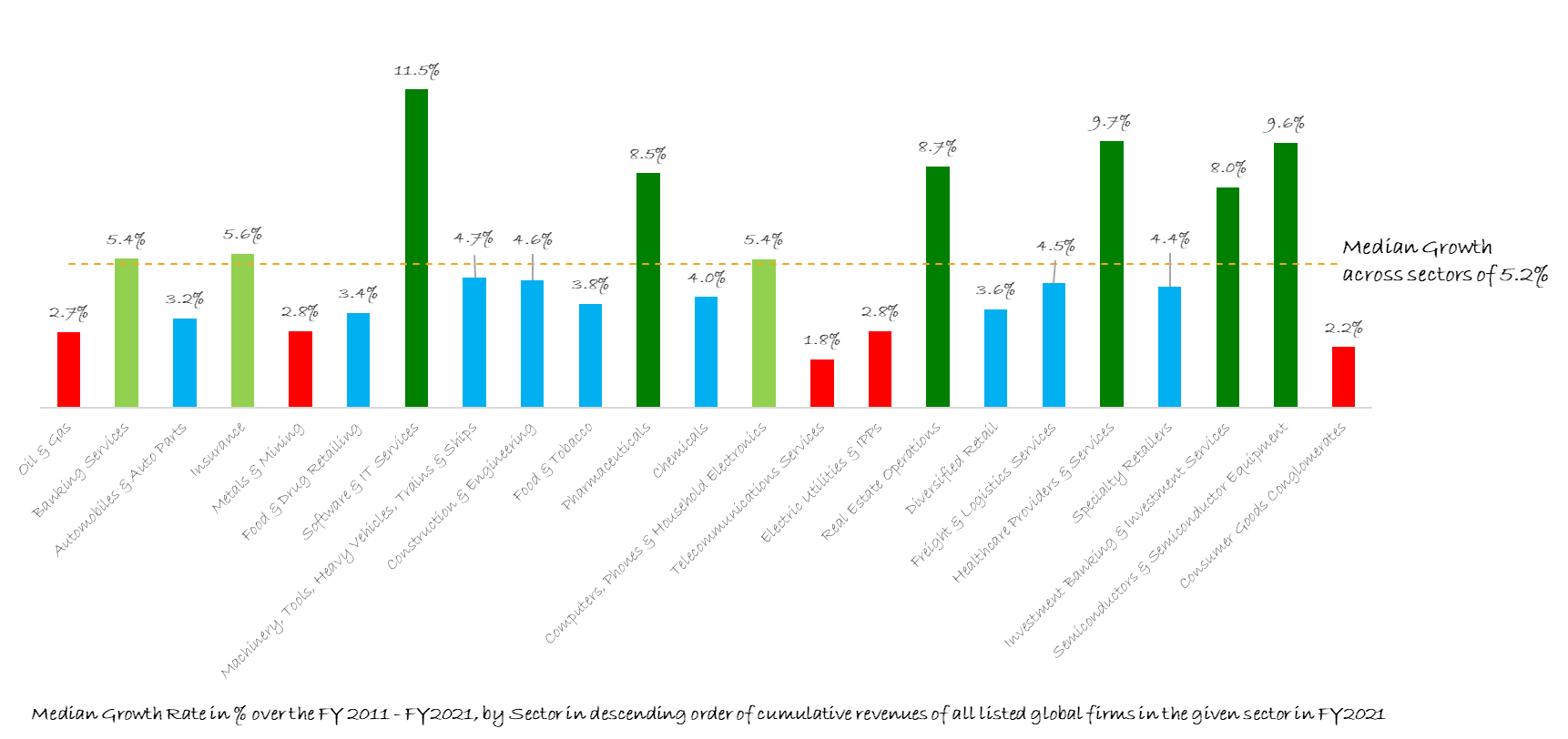

But how did this global economic growth get reflected in the growth rates at industry levels over the years?

The global revenues for the 22,000+ publicly listed firms (with revenues greater than USD 100 million for the financial year 2021) grew at a median rate of 5.2% during the financial year 2011-2021 period.

Software & IT Services, Pharma & Healthcare, and Financial Services (Banking & Insurance) have emerged as the key sectors that led the growth.

At the same time, the traditional sectors of Oil & Gas, Metals & Energy, and even Telecom and Consumer Goods! have witnessed only marginal growth.

As the global socioeconomic and consumer & employee behavior landscape evolved over the last decade, disruptive technologies and innovation emerged as the keywords in the corporate lingua.

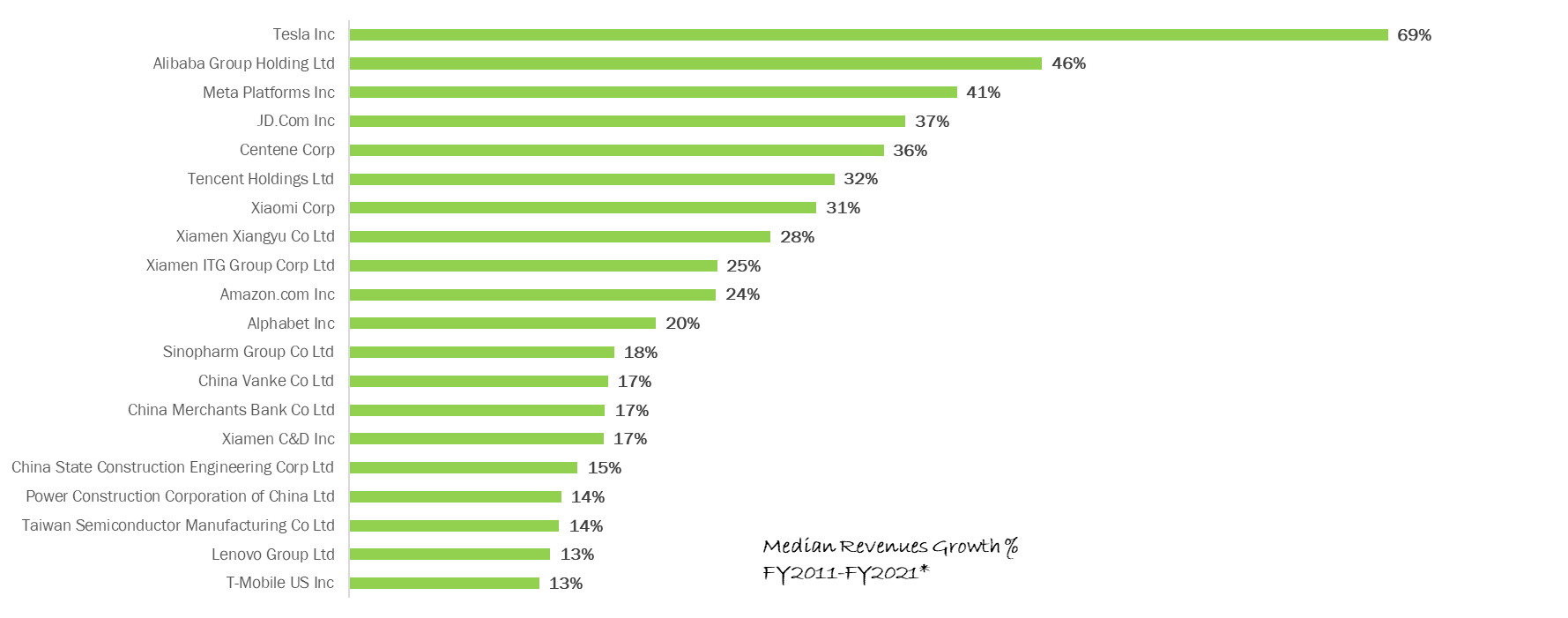

Leaving aside the turmoil seen in its market capitalization and the cascading impact on the fortunes of Elon Musk in 2022 (amidst his Twitter adventure!), Tesla has become an icon - a symbol of innovation within the business world.

From an unknown entity, it started featuring in the lists of most innovative companies in the world by the likes of Fast Company, Forbes, BCG, etc., in the early part of the decade of 2010s.

And, staying with revenues as a metric as the representative of an organization's performance - Tesla's revenues grew from a mere USD 204 million in the financial year 2011 to a staggering USD 53.8 billion in the financial year 2021. Now, that's a phenomenal 264x jump - a 70% annualized growth rate! While the future of Tesla is an obvious conversation topic - one can't simply ignore the growth it has achieved consistently and sustainably over 10 years.

But Tesla is not an outlier.

19 other regional and global organizations across Software & IT Services, Online Retail, and Healthcare, but even the conventional sectors of Real Estate, Construction, and Industrial Goods grew consistently over the years and emerge as one the top 20 fastest-growing mega-large organizations among their 216 that had revenues greater than USD 50 billion for the financial year 2021.

Each of these firms has leveraged disruptive technologies and innovation. They consciously worked toward becoming “scalable,” “adaptable,” and “resilient.”

While one could argue that several of these organizations are from China, where the local economy has grown at a pace far higher than the rest of the world, we know that the likes of Alibaba and Lenovo, and Tencent have flourished not just locally in China BUT across geographies.

Also, worthwhile pointing out the growth of T-Mobile in the USA. While the global telecom industry revenues (as shown in the earlier graph) grew by only 1.8% annually over the last decade, T-Mobile expanded its revenue base by nearly 13% per annum between 2011-2021. That's not a lot compared to Tesla's 70% annual growth rate - BUT - it's nearly 7X its peer group!.

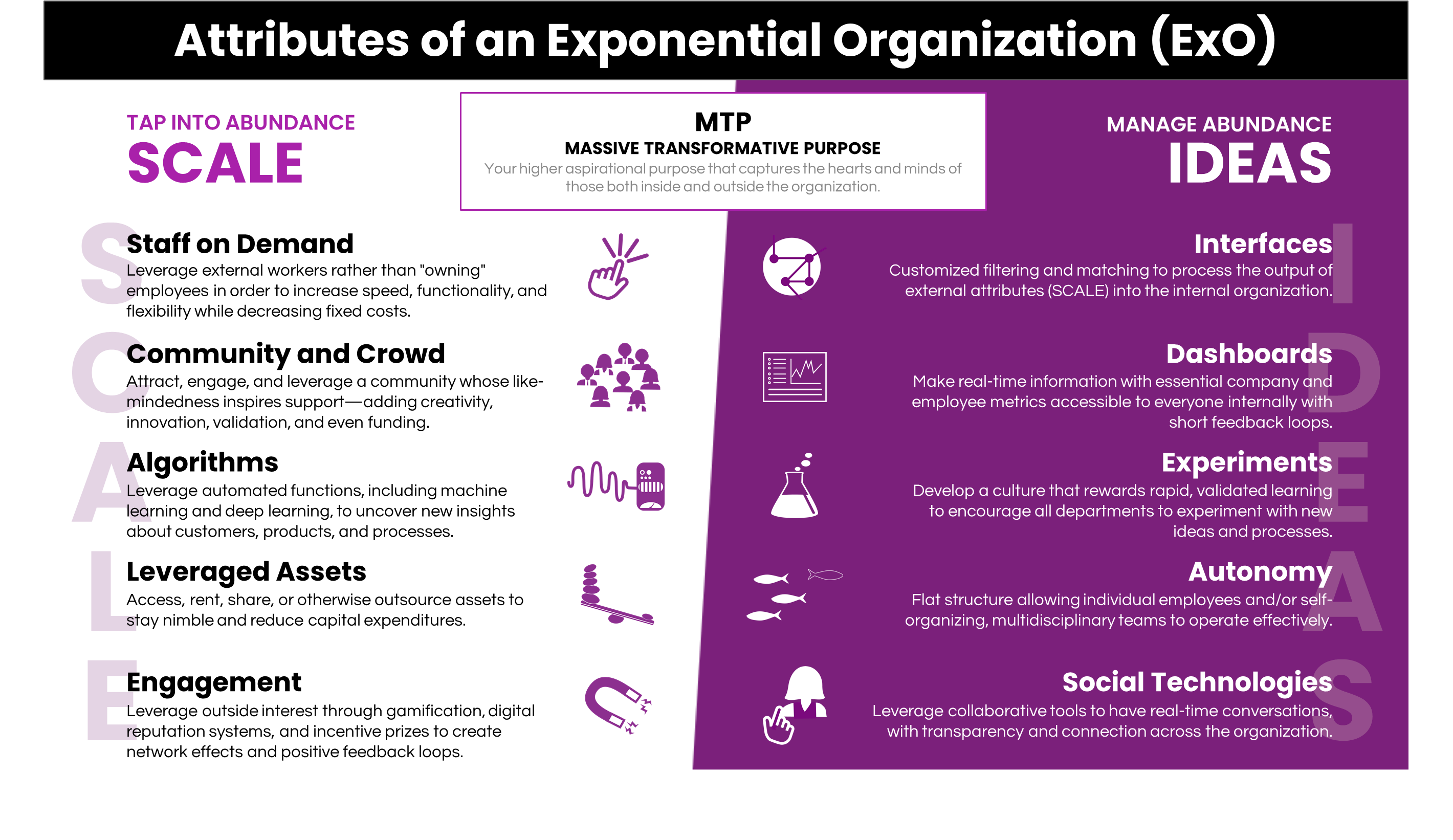

Put simply, each of these 20 organizations could be considered to have embraced and embedded several, if not all of the 11 exponential attributes of MTP + S.C.A.L.E. + I.D.E.A.S. of the Exponential Organizations framework.

To outperform their peers. To deliver growth on a consistent and sustainable basis. And not just be a one-year wonder.

After all, 10 years is a long period in today's context - isn't it?

On the other hand, we had 20 mega-large organizations, which, while having revenues of more than USD 50 billion in the financial year 2021, had negative growth in their toplines over the 2011-2021 period.

Each of these organizations is a classic example of having failed to reimagine and reinvent themselves entirely or on a timely basis to seize the abundance of opportunities available to them as much as their peers.

Several of them come from the Oil & Gas, Energy, and Metals arenas, which have been following what could be called conventional “linear” and “non-resilient” business & operating models.

It might sound ironic, but Equinor is an interesting example amongst these bottom 20 mega-large corporations which witnessed declining revenues. An organization within the Oil & Gas arena, Equinor has tried to transform and reinvent itself by shifting gears from conventional fossil fuels to green energy. While it's chosen to divest a lot of its portfolio and invest heavily in solar and wind energy - its revenues declined from USD 120 billion in 2011 to USD 45.7 billion in 2020 before recovering to USD 88.8 billion in 2021. While the intent has certainly been in the right direction, it's the underlying strategy and the execution that failed miserably. It's not being able to let go of the linear mindsets, skillsets, and ways of working. As a result, it has witnessed several large-scale failures of new business ventures.

For example, Equinor admitted a major US failure in 2020 as a "Tough reading"! An eager attempt at securing growth ended up impairing both value and control, not least considering that business oversight and expertise were sorely lacking for the administration of onshore oil extraction. Much should have been done differently, Equinor CEO Eldar Sætre had conceded following a report on the oil company's US onshore fossil fuel venture.

It's also interesting to see IBM - from the Information Technology sector which had its revenues decline from USD 106.9 billion in 2011 to USD 57.35 billion in 2021. That's almost a 50% fall. I had talked about IBM as a case study in OpenExO's publication - The Success Imperative - an analysis of the Fortune 100 organizations - that "immunity is not guaranteed" - once an exponential organization, IBM failed to sustain its edge and lost the plot.

AIG and Santander are other examples of firms that failed to deliver, while some of their peers within the Banking and Financial Services space have thrived and increased their toplines. I will be deep-diving into these 2 organizations (and a few other stories of success - aka the top 20, and of failures - aka the bottom 20) in subsequent articles. Watch out, should you be interested.

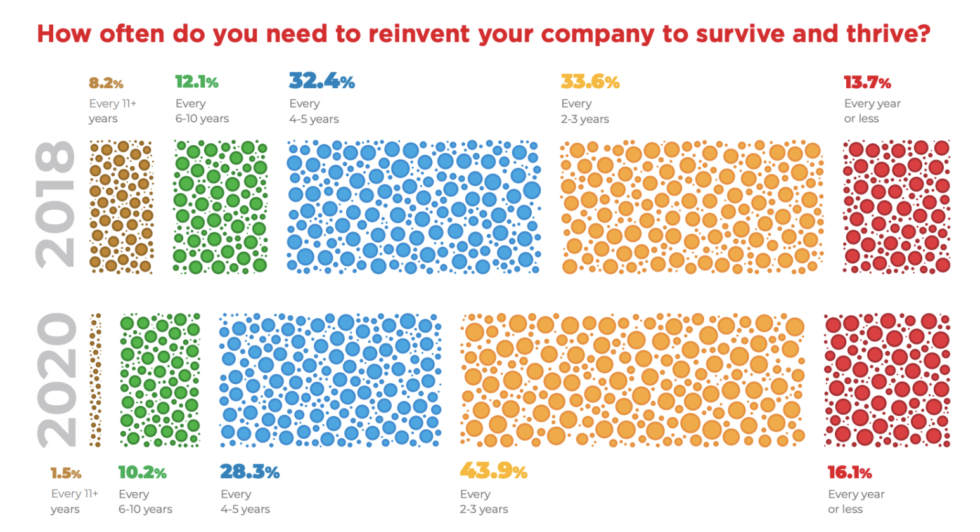

A global survey done in 2020 showed that nearly 60% of business leaders surveyed opined that they would need to reinvent their company regularly (every year or at least every 2-3 years). This was a significant 20% increase over the results from the last survey done in 2018.

Though the survey wasn't repeated in 2022, it's most likely that the number of business leaders talking about reinventing themselves has only continued to increase over the last 2 years.

The challenge, however, is that while business leaders might be talking the talk, they are not walking the walk regarding reinvention.

In the 2016 Annual Report, Jeff Bezos of Amazon wrote below about a question he had received during his most recent all-hands meeting. “Jeff, what does Day 2 look like?”. And he stated that his response was, "I’ve been reminding people that it’s Day 1 for a couple of decades. I work in an Amazon building named Day 1, and when I moved buildings, I took the name with me. I spend time thinking about this topic. Day 2 is stasis. Followed by irrelevance, followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1.”

In the face of today’s disruptions, the temptation for some business leaders might be to focus solely on survival. To manage the short-term outcomes - weekly, monthly, and quarterly targets. And even worse, follow a linear business model and mindset while executing different strategic and operational priorities.

But this would be fundamentally misguided.

Here’s why having a long-term exponential mindset, while sometimes difficult, is critical. Periods of rapid change like the ones we are witnessing now create space for new ideas and opportunities for senior business leaders and corporate boards to present new visions for the future. One can't gainsay that our natural tendency in tough times is to turn inward and take a defensive posture. But we know this stifles creative thinking, innovation, and strategic risk-taking—precisely the behavior needed in times of rampant dislocations.

Organizations that set brave long-term visions and pursue BHAGs (big hairy audacious goals) today will define the future.

Business leaders need to balance the need to defend against near-term threats and being a creator of long-term sustainable value for multiple stakeholders.

So, if you are one of those business leaders who doesn't want to merely survive or perhaps even see declines (similar to those witnessed by the bottom20 mega-large organizations highlighted above) and, in fact, prefer to thrive in the rest of the decade of 2020 - then - it's never too late to start your reinvention.

You can shift from being a linear business leader and organization - to one which is exponential - agile, flexible, and scalable. You can become future-ready and grow to be the next example, similar to the top 20 mega-large organizations which have thrived in the last decade, as highlighted above.

Being Exponential is not a choice anymore - It's an Imperative.

Either you DISRUPT - OR - GET DISRUPTED.

ExO Insight Newsletter

Join the newsletter to receive the latest updates in your inbox.