Corporate Governance Needs An Exponential Shift

With only 1% of the global publicly listed companies scoring high on the Governance metrics, we need a paradigm and exponential shift in Corporate Governance to protect and create inclusive, holistic, and sustainable stakeholder value.

Over the last few years, we have been witness to a large number of cases and scandals demonstrating the gaps and blind spots in place when it comes to managing an organization's financial and reputational risks.

Corporate Governance refers to the way in which companies are governed and for what purpose. It is, in essence, a framework that enables management to deal more effectively with the challenges of running a company. It is concerned with practices and procedures for trying to make sure that a company is run in such a way that it achieves its objectives while ensuring that stakeholders can have confidence that their trust in that company is well founded.

Good corporate governance ensures that businesses have appropriate decision-making processes and controls in place so that the interests of all stakeholders (shareholders, employees, suppliers, customers, and the community) are balanced. Good quality, ethical decision-making builds sustainable businesses and enables them to create long-term value more effectively.

But, over the last several decades and more so in recent years - we have increasingly seen debacles in corporate governance of bigger and more significant proportion.

Credit Suisse, the Swiss banking major, is a prime and live example of the crisis of corporate governance. The embattled bank has been struggling to regain investor confidence, with the stock having lost more than 66% by the end of November since the start of the year 2022.

In recent years, Credit Suisse has suffered a number of scandals, including trading jobs for business in Hong Kong, hiring private detectives to spy on their executive team, laundering money for a criminal organization in Bulgaria, facilitating corrupt loans in Mozambique, having unjustifiable exposure to funds like Archegos Capital and Greensill Capital, both of which collapsed, resulting in the bank booking massive multi-billion dollar losses.

Speculation that the bank could fail has invoked comparisons with the 2008 collapse of United States’s investment bank Lehman Brothers, which precipitated the worst economic crisis since the Great Depression.

The epic collapse of wunderkind Sam Bankman-Fried’s $32bn crypto empire, FTX, looks set to go down as one of the great financial debacles of all time. With a storyline full of celebrities, politicians, sex and drugs, the future looks bright for producers of feature films and documentaries.

Credit Suisse's and the FTX sagas are not an exception.

We have had the Facebook Data Privacy fiasco. In early 2018, news sources revealed that over 87 million Facebook users’ data leaked to the political consultancy Cambridge Analytica. Worse yet, Facebook admitted they knew Cambridge Analytica had been siphoning off data through a program called This Is Your Digital Life and did nothing about it.

We saw Theranos, an American privately held corporation that was touted as a breakthrough health technology company. Founded in 2003 by then 19-year-old Elizabeth Holmes, Theranos raised more than US$700 million from venture capitalists and private investors, resulting in a $10 billion valuation at its peak in 2013 and 2014. The company claimed that it had devised blood tests that required very small amounts of blood and that could be performed rapidly and accurately, all using compact automated devices that the company had developed. These claims were later proven to be false.

We had the VW scandal, dubbed the "diesel dupe". In September 2015, the Environmental Protection Agency (EPA) found that many VW cars sold in America had a "defeat device" - or software - in diesel engines that could detect when they were being tested, changing the performance accordingly to improve results. The German car giant admitted to cheating emissions tests in the US. The scandal sparked the biggest business crisis in VW's modern history, costing the company more than €32 billion in vehicle refits, fines, and legal costs to date, perhaps most notably in the US and Germany.

And perhaps the most significant being WORLDCOM and ENRON.

Enron was the “it” company at the turn of the century as it oozed wealth, smarts, and power. However, this Houston-based energy company toppled into a spectacular bankruptcy due to a painstakingly-planned accounting fraud made by its accounting firm, Arthur Andersen. Once considered a blue-chip stock, Enron shares dropped from $90 to $0.50, which spelled disaster in the financial world when thousands of employees and investors saw their savings vanish with the company as it filed for an earnings restatement in October 2001. This case truly brought corporate governance into the mainstream.

The US’s second-largest long-distance phone company, WorldCom, filed for Chapter 11 in 2002. However, an internal audit report showed that the company had been using fraudulent accounting methods to hide its declining financial condition. The company’s assets were inflated by around $11 billion, with $3.8 billion in fraudulent accounts. The company was purchased by Verizon Communications and was renamed Verizon Business Division. It’s worth noting that this scandal prompted the approval of the Sarbanes-Oxley Act by the senate, which introduced the most sweeping new business regulations since the 1930s.

Despite these infamous scandals, the resulting regulations, and the emergence of governance metrics (as part of the broader ESG agenda) - embedding good governance into an organization's operating model and its culture is still seen as a holy grail.

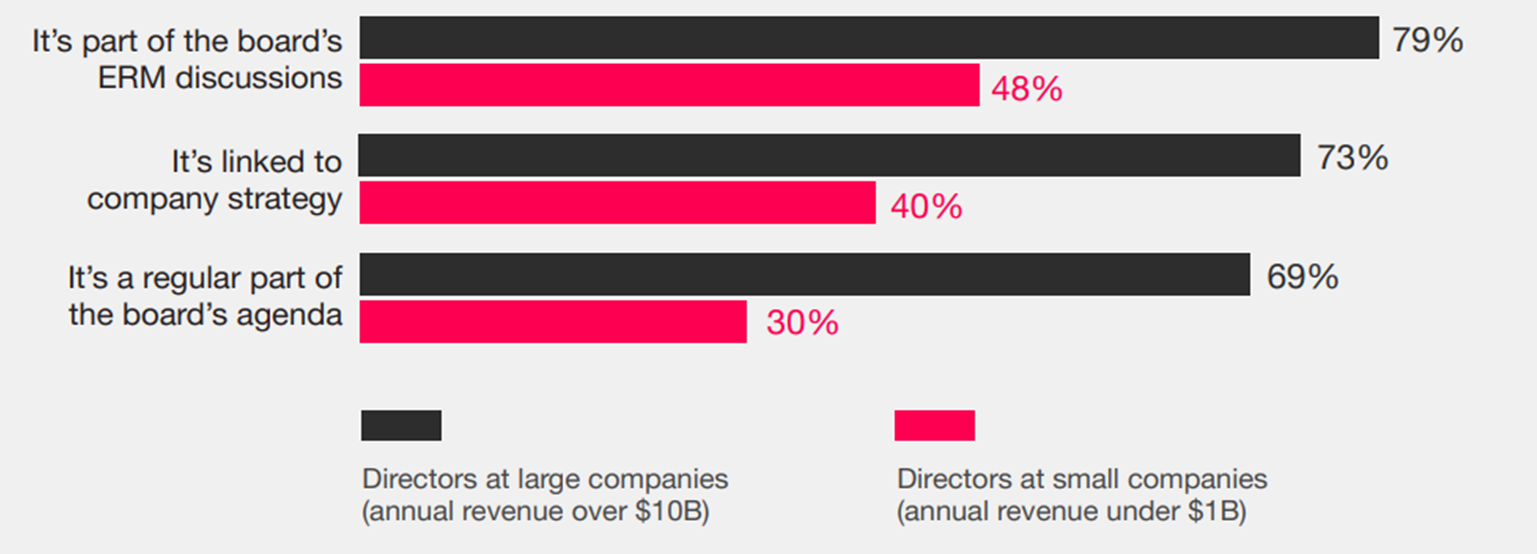

As per the findings of a recent Annual Corporate Directors survey by PwC around Governance (and ESG at large) being a focus, the gap is evident (image below).

Further, as per the same survey, Directors are less likely to see a connection between ESG and company fundamentals.

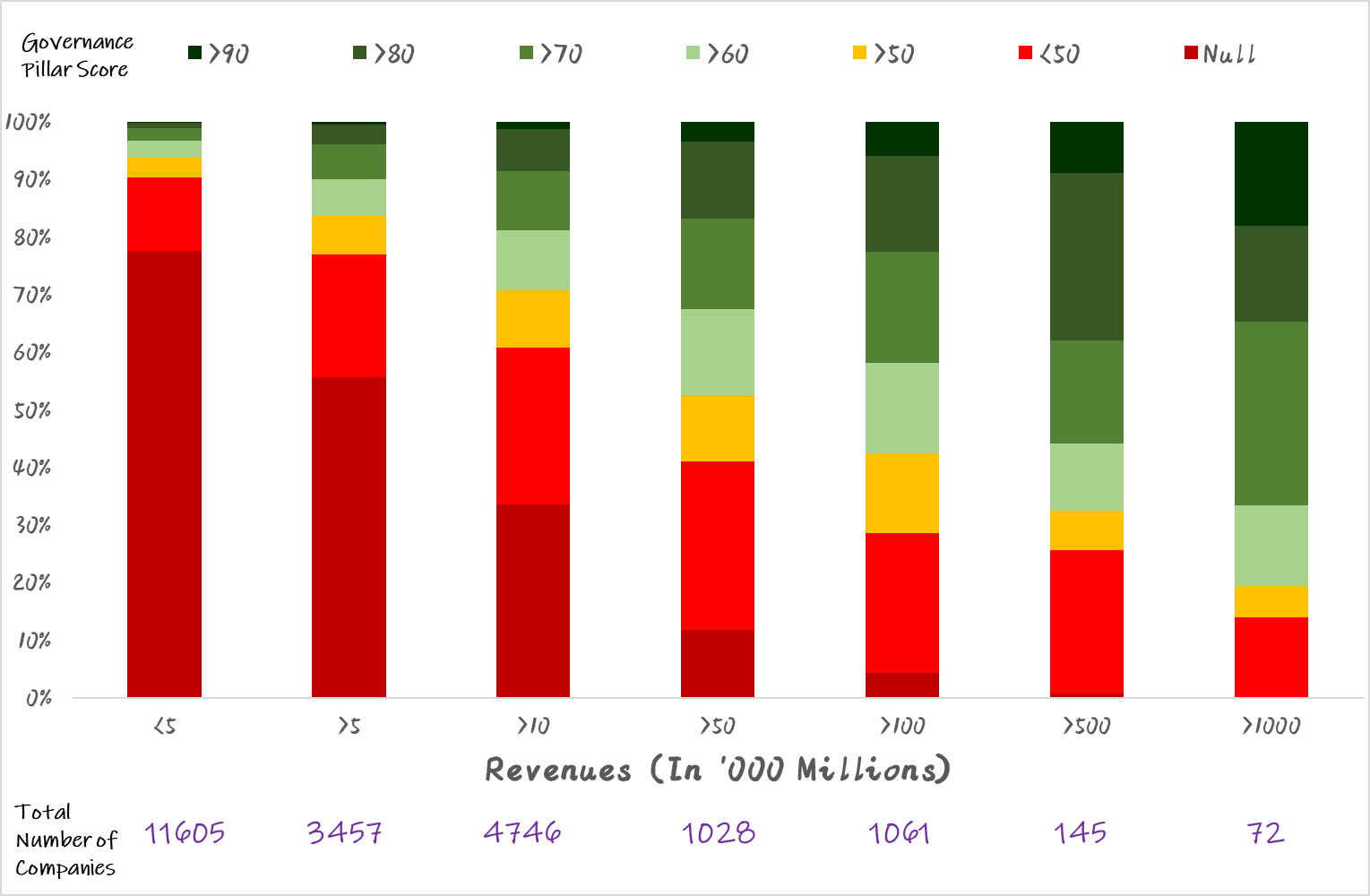

Refinitiv assesses the key elements of Structure - independence, diversity, committees | Shareholder rights | and ESG reporting and transparency of an individual organization to establish a quantitative score in the range of 0-100.

An analysis of 22,000+ publicly listed global firms having revenues greater than $100 Million for the financial year 2021 shows that -

➡️ ONLY 42% did the minimal reporting of their business practices with respect to the Governance pillar to become eligible even to get scored!

➡️ Only 1% scored more the 90 on the Governance pillar as per Refinitiv's methodology.

➡️ A mere 3% of the 11,600+ smaller companies with a turnover of less than $500 million scored 70 points or above on the Governance pillar as per Refinitiv's methodology, more than two-thirds of the world's largest firms having revenues of more than $100 billion crossed that threshold.

SO, WHAT CAN WE DO?

Business leaders across industries, geographies, and organization sizes need to be intentional and proactive in how they manage THE GOVERNANCE agenda in their unique context.

Anyone who has been in a board room during the past couple of decades has heard governance experts repeatedly explain how the company needs to implement specific actions that may make zero sense for that particular business or else risk being viewed as a governance pariah. How did we get this way?

One could argue that while the principles of good corporate governance have been well-established for several years now, the framework and execution (or lack of it) have failed to deliver the desired outcomes.

As the adage goes - What Got Us Here Won't Get Us There.

We need a paradigm shift in our thinking and doing around Corporate Governance. We need to shift from linear standards and practices to an exponential approach that involves the boards and executive team to evaluate, improve and reimagine the organization's purpose, the business and operating model, and most significantly, themselves as leaders.

Several companies try to address these issues (more often than not, at least for good PR) by having impressive board rosters with titans of industry, ex-bureaucrats, and even politicians. But. even such boards often shy away from asking the tough and right questions to protect the value-creation engine.

The challenge is that challenging the status quo goes against our basic human nature. Our primitive brains are wired to avoid friction and conflict, and to think linear and incremental. But your primitive brain is lying to you: If you don’t say the hard things, the organization will end up fighting for its survival with a cascading series of crises that you didn’t predict and that you haven’t prepared for.

Hence, a progressive organization embraces an exponential approach toward Corporate governance wherein the leadership

✅ Adopts a Massive Transformative Purpose (MTP) that is inclusive and holistic toward creating a better world for all stakeholders.

✅ Fosters Autonomy and Psychological Safety across the wider organization by raising uncomfortable truths about the company, facilitating healthy skepticism, and encouraging candid question-asking.

✅ Leverages Dashboards to get information on the performance status against the organization's purpose, strategy and what the potential risks are.

✅ Links Executive Compensation to the Corporate Governance agenda and ensures greater board oversight of the Code of Conduct.

While 2023 and the years ahead will still bring challenges, business leaders have unique opportunities for sustainable and inclusive progress if purpose-led corporate governance is at the core of what they do.

In 2014, a seminal book titled EXPONENTIAL ORGANIZATIONS by SALIM ISMAIL was released to decode and share the secret sauce behind such radically better business performance. The book is now one of the top-selling business books of all time. After the book’s release, a study was undertaken to analyze the US Fortune100 organizations through the lens of this ExO success formula – the 11 Exponential Organization attributes of MTP + SCALE + IDEAS. The study identified the top10 exponential organizations (the most flexible and adaptable) and bottom10 non-exponential organizations (the least flexible and adaptable) amongst the Fortune100. The study also asserted that the most exponential organizations would deliver higher levels of resilience and impact. We analyzed these organizations over the eight-year period of 2014 to 2021 (including the pandemic years) and are not surprised that the ExO success formula has stood the test of time. Download the report today.

ExO Insight Newsletter

Join the newsletter to receive the latest updates in your inbox.